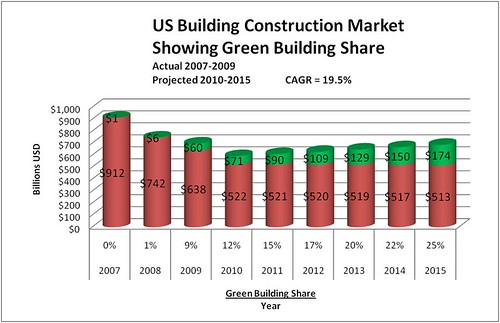

Since the fall of 2008, US spending on conventional

building construction both residential and commercial has been nearly halved to $520B from $912B. The adjustment in the residential segment is even more stark from $670B in 2006 to $230B in 2010 a 66% reduction (

here). We have truly witnessed a transformational change in the marketplace.

Change has led to margin compression and

firm collapse, and if not for tax rule changes in the '08 federal stimulus package which permitted home builders to offset current losses against prior year tax liabilities, we might have witnessed the collapse of many large home building firms. Call it, "

The Home Builder Bailout." On the employment side, we see the largest displaced worker ratio with more than 22 job

seekers for every job

opening as of November 2010. Going forward economists predict sluggish growth for the economy in the, 2-3% range, for an

extended period. For the survivor firms, more of the same margin compression can be expected for quite some time. During the same period the

green building segment posted extraordinary growth to $71B in 2010 from less than $1B in 2007. The segment is expected to achieve nearly a 20% year-on-year growth through 2015. By then green building is expected to consume one of every four dollars spent on building construction. Growth is being fueled by government purchasing and private owners who recognize

the superior ROI on going green. It is just good business. So for constituents in the building construction supply chain, going green is THE way to make green in this "New Normal" economy.